When you make a new claim or tell us about a change in your circumstances, we'll send you a letter. The letter will tell you how much benefit you will get and how it is calculated.

You can view your benefit entitlement and letters on your MyHarrow Account.

Changes to your entitlement

If your benefit entitlement has changed, find out What to do if your benefit entitlement has changed.

Your benefit entitlement letter

For help to understand you letter, see our Example housing benefit letter. It explains what the different sections mean.

Reverse of benefit entitlement letter

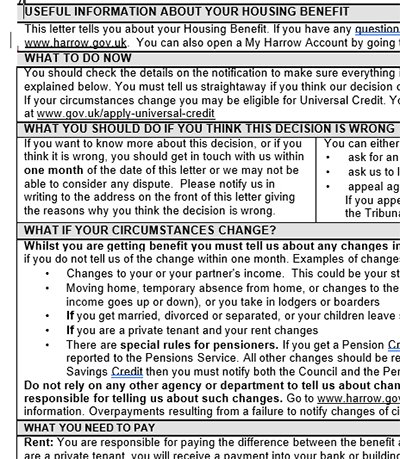

On the back of your benefit entitlement letter there is some useful information. A section of this is shown in the image below. The text featured on it can be found in full in the expandable boxes below the image:

Useful information about your housing benefit

This letter tells you about your Housing Benefit. If you have any questions you may find the answer at www.harrow.gov.uk. You can also open a MyHarrow Account by going to the above webpage

What to do now

You should check the details on the notification to make sure everything is correct. Some of the terms used are explained below. You must tell us straightaway if you think our decision on your claim is wrong, and your reasons.

If your circumstances change you may be eligible for Universal Credit. You can find out more and make a claim online at www.gov.uk/apply-universal-credit

What you should do if you think this decision is wrong

If you want to know more about this decision, or if you think it is wrong, you should get in touch with us within one month of the date of this letter or we may not be able to consider any dispute. Please notify us in writing to the address on the front of this letter giving the reasons why you think the decision is wrong.

You can either:

- ask for an explanation, or

- ask us to look again at the decision, or appeal against the decision - this must be in writing. If you appeal an independent tribunal administered by the Tribunals Service will hear your appeal.

What if your circumstances change?

Whilst you are getting benefit you must tell us about any changes in your circumstances. You will lose benefit

if you do not tell us of the change within one month. Examples of changes include:

- Changes to your or your partner's income. This could be your state benefit, allowances, or earnings.

- Moving home, temporary absence from home, or changes to the people in the household (including if their income goes up or down), or you take in lodgers or boarders

- If you get married, divorced or separated, or your children leave school or become adults

- If you are a private tenant and your rent changes

- There are special rules for pensioners. If you get a Pension Credit then changes to your income must be reported to the Pensions Service. All other changes should be reported to the Council. If you are getting a Savings Credit then you must notify both the Council and the Pension Service about changes to your capital.

Do not rely on any other agency or department to tell us about changes in your circumstances. You are responsible for telling us about such changes. Go to www.harrow.gov.uk/benefits/report-change for more information. Overpayments resulting from a failure to notify changes of circumstance will be recovered.

What you need to pay

Rent: You are responsible for paying the difference between the benefit awarded and your full housing costs. If you are a private tenant, you will receive a payment into your bank or building society account, or your landlord will be paid directly. If you are a council tenant, your benefit will be paid directly to your rent account.

Dates for the regular payments of Housing Benefit are available on our website www.harrow.gov.uk/benefits

Explanation of terms used on decision notice

Your Earned Income - If you are working, any earnings will be shown here as a weekly figure.

Any Other Income - All other types of income, including any partner's earnings, tax credits, child benefit, state pensions, private pensions, tariff income from capital

Your Total Capital - This is the total amount of capital and savings held.

Your Weekly Eligible Rent - This is the amount of rent on which benefit can be paid and can be less than the amount of rent that you actually pay. The amount of benefit we can pay may be based on a decision made by the Rent Service, the Local Housing Allowance rate, or depend on the number of rooms the law says you need.

Ineligible Weekly Fuel and Service Charges - This amount is an estimate of any charges made within your rent for fuel charges, water rates, laundry provision etc. These can be amended if you provide evidence of actual charges.

Expenses - These include items like childcare costs and payments towards the support of a student.

Payment on Account:

- (I) Interim Payment - This is a payment made pending the receipt of further information.

- IRL (Indicative Rent Level) - Until we receive a rent officer decision, we will calculate benefit using an Indicative Rent. If we find that we have overpaid you when we receive the information, we will ask you to repay the overpaid amount.

Non-Dependant Deductions - Non-dependants are other adults living in your home. Some of them may be expected to contribute towards your rent. A deduction from your benefits may be made, according to the individual's income.

Applicable Amount - This is the weekly figure that the government has worked out as the amount needed for day-to day living expenses. It is based on your individual circumstances.

Late Notification - changes which are notified to the Council more than one month after the event.

Overpayment - this is the amount we paid you, to which you were not entitled. It will have to be repaid to the Council. It may be deducted from your ongoing Housing Benefit entitlement.

We can recover overpayments from Housing Benefit paid direct to your landlord for other tenants. If this happens your rent will legally be deemed as paid to the full value of your Housing Benefit entitlement.

If you are struggling with your finances, please see Help with the cost of living.

Your entitlement

- Weekly benefit award: the maximum amount of benefit you are entitled to on a weekly basis.

- Less overpayment recovery: the amount that is taken from your weekly benefit award if you have an overpayment. The amount will be taken until the overpayment is cleared.

- Net benefit payable: the amount of benefit you will get each week after any overpayment deductions are taken.

- The first payment will be: the date of your first payment. Information about your first and future payments will only be shown if it is a new claim. If it is not a new claim then you can check your future payments on your MyHarrow account.

- Non-dependant deductions: the amount of benefit you are entitled to may be reduced if you have other adults who share your home and they are not responsible for paying the rent. They could be an adult son or daughter, or an elderly relative. The amount of the deduction will depend on the income of the non-dependant.

- Applicable amount: this is the amount the government says you need to live on. It varies depending on your age, the size of your family, and any special needs you have (such as disabilities). If your income is more than your applicable amount then you have excess income. Your housing benefit will be reduced by 65 pence for every £1 of excess income.

Rent and service charges

- Weekly gross rent: the amount of rent your landlord charges you including service charges.

- Weekly eligible rent: how much rent will be taken into consideration when we assess your benefit. It might be lower than your gross rent due to the Local Housing Allowance or the social sector size criteria.

- Weekly ineligible service charges: services provided by your landlord that are included in your gross rent but can not be paid by Housing Benefit. For details see eligible rent for housing benefit.

Income and expenses

If you get passported benefits it will be stated under your financial details. None of the headings below will be shown if you get passported benefits.

- Your/your partner's weekly earned income: income from any work you or your partner do. The figure shown is after tax, national insurance and half of any pension contributions are deducted.

- Other income (converted to weekly): income from any other source. This could be tax credits, child benefit or pensions. Some types of income will be included here even if they are not used in the final benefit calculation.

- Assumed income from capital: 'capital' means any of the following - savings, cash, property and investments. If your capital is less than £6000 it does not affect your entitlement. For every £250, or part thereof over £6000, £1 will be added to your total weekly income. This applies regardless of whether the capital generates any income. If you have capital over £16,000 you cannot get Housing Benefit or Council Tax Support.

- Disregarded income: income that is not counted when we assess your benefit. It is subtracted from the total weekly income figure. It includes child benefit and some of your earned income as set by the government.

- Less expenses: this will show if you are eligible to have expenses such as childcare costs deducted from your total income.